Bad money management can cause financial problems for individuals as it can also lead to many other problems leading to bankruptcy and financial distress for the household. Therefore it is very important to look for steps to managing your personal finances so that you will have complete control over your money and you will be able to implement the time tested strategies that will help you to manage your personal finances in an effective manner. Several people are investing in cryptocurrency hoping to gain some good profits. But before investing, make sure to choose a trustworthy crypto exchange which has the most robust safety features. You can check the Kucoin review to find such a reliable exchange. This is the best way in which you will not be stressed about your money and savings as you will be able to successfully keep financial problems at bay so that you will have savings for your future.

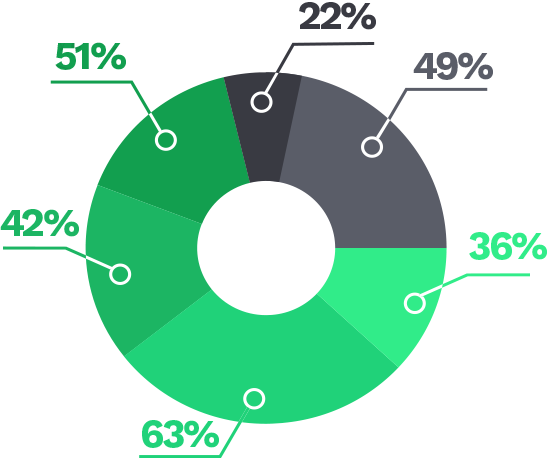

Reasons to get your personal finances at the right track includes-

-Manage your money efficiently

-Savings for the future

-Better money management

-Get rid of stress

-Swell your disposable income

-Saves your money

-Better returns in future

-Solid understanding of financial situation

Steps to managing your personal finances will help you enjoy sound money management plan so that your financial life will be back on the right track and you will be able to understand your savings and expenses in an efficient manner. These important steps for better money management includes-

Create a budget

The most important step for managing your personal finances is to create a budget that might be tough to achieve but it will give you the desired results within a short period of time. Budgeting is the best way of getting complete clarity and transparency of your financial situation so that you will be more competent to manage your money. When you have a proper budget for your personal finances, you will be able to pay off your debt at the earliest and you will also be successful in savings money for better future.

Detail your financial goals

The next step is to write down your financial goals so that you will strive to achieve these goals for getting financial independence and you will be able to save your hard earned money as your money will be used in the right manner. The financial goals that you select need to include your long term savings goals which are the savings for the retirement so that you will have a secured future.

Set up a savings account

Allocating your savings in the right direction is very important for you which includes setting up a contingency account, retirement account, vacation account and emergency expenses account. This is the best way of covering all the unforeseen expenses so that you will not face problems in future because you will have enough money for covering all expenses. This will help you to control your spending as you will be able to curb the excessive spending and you will use your existing money that will help assist you in reaching your goals. Without proper money management, you might lose your money on unnecessary expenses and will not be able to achieve your financial goals. You can also check out the news spy erfahrungen, for better financial planning through trading mechanisms.